GTR locks in drilling contractors for US uranium project

Our US uranium Investment GTI Energy (ASX: GTR) is gearing up to drill its US uranium asset.

Today, GTR confirmed that drilling contractors had been locked in for a 71 hole drill program at its Lo Herma project.

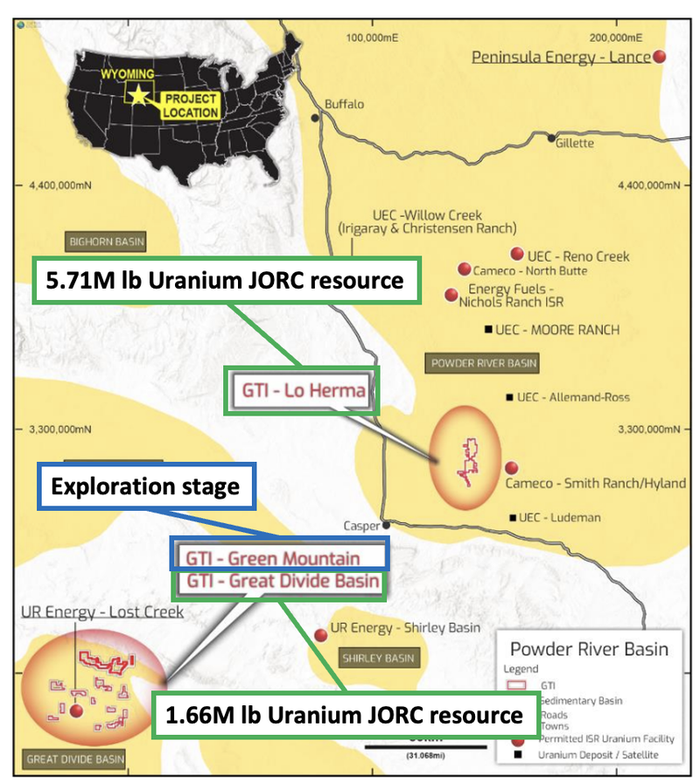

Lo Herma is one of GTR’s three uranium projects in Wyoming, USA.

Lo Herma holds 5.71mlbs of GTR’s total 7.37mlbs JORC uranium resource.

The primary objective for GTR’s 2024 drill program will be to try and increase its JORC resource at Lo Herma - an updated resource is expected after the drilling results come back in.

We are Invested in GTR to see it drill out all three projects and increase the size of its JORC resources and hopefully one day attract interest from majors operating in Wyoming.

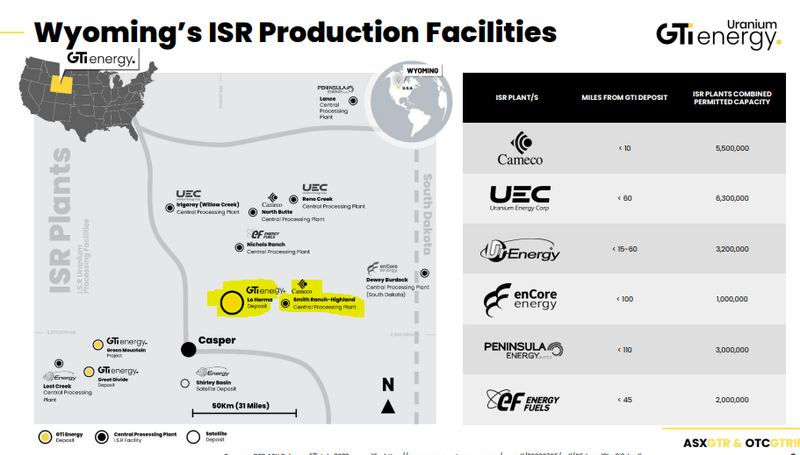

GTR’s projects sit within ~160km of 7 permitted uranium processing facilities and ~16km away from Cameco’s Smith Ranch-Highland plant (the USA’s biggest ISR uranium production facility).

With the US senate just yesterday approving a ban on Russian Uranium supply into the US we expect the value of US based uranium projects with existing resources will increase.

Especially if the projects are in the right area and have the potential to be bolt-on acquisitions for majors with processing facilities that have capacity to process additional uranium.

(Source)

Below is a map showing where GTR’s assets sit relative to the major processing facilities in Wyoming.

What’s next for GTR?

Drill permitting for projects in Wyoming 🔄

We want to see GTR get all of the permitting in order for its 2024 drill program which the company expects to start in Q3-2024.

JORC resource upgrades 🔄

We want to see GTR increase its JORC resources (hopefully off the back of good drill results) - at the moment, GTR has guided for upgrades in Q4-2024.